CRA My Account

Contribution Limits

Your CRA My Account allows you to view your Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) contribution limits. Click on the buttons below to take you the relevant instructions.

Click here if you need Registration and Sign-In Instructions.

Registered Retirement Savings Plan (RRSP) Contribution Limit

Knowing your Canada Registered Retirement Savings Plan (RRSP) contribution limit is important for a number of reasons, including the following:

- Maximizing tax savings: Your RRSP contributions are tax-deductible, meaning that they reduce your taxable income for the year. Knowing your RRSP contribution limit can help you maximize your tax savings by ensuring that you contribute the maximum amount allowed.

- Planning for retirement: Your RRSP is an important tool for retirement planning, and knowing your contribution limit can help you plan and save for your retirement more effectively.

- Avoiding penalties: If you exceed your RRSP contribution limit, you may be subject to penalties and taxes. Knowing your contribution limit can help you avoid these penalties and stay within the legal limits.

- Managing cash flow: Knowing your contribution limit can help you manage your cash flow by allowing you to plan your contributions over the course of the year, rather than making a large lump sum contribution at the last minute.

- Making informed financial decisions: Knowing your RRSP contribution limit is a key piece of information that can help you make informed financial decisions about your retirement savings and overall financial planning.

Once you are signed in to your CRA My Account, you can check your current RRSP Contribution Limit.

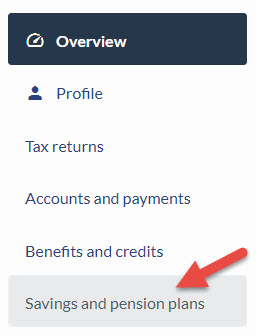

Step 1 - Overview Screen

- From the CRA My Account Overview screen, click on the Savings link on the right Navigation

- This will take you to the Savings and pension plans screen

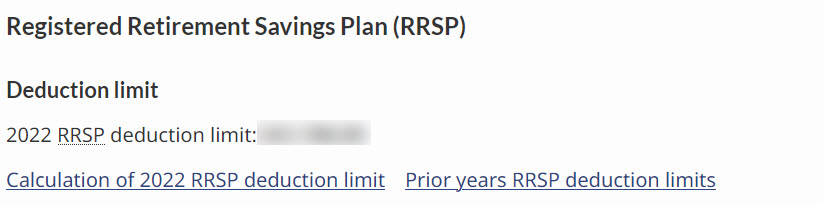

Step 2 - Deduction Limit

- Your most recent RRSP Deduction Limit is listed on the under Deduction limit

- You can also click on the links to see:

- Calculation of current year RRSP deduction limit

- Prior years RRSP deduction limits

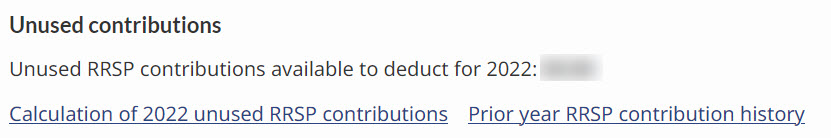

Step 3 - Unused Contributions

- Your unused RRSP contributions are listed under Unused cotributions

- You can also click on the links to see:

- Calculation of current year RRSP deduction limit

- Prior years RRSP contribution history

Tax-Free Savings Account (TFSA) Contribution Limit

Knowing your Canada Tax-Free Savings Account (TFSA) limit is important for several reasons, including the following:

- Maximizing tax-free savings: Your TFSA contributions are not tax-deductible, but any investment income or capital gains earned within the account are tax-free. Knowing your TFSA contribution limit can help you maximize your tax-free savings by ensuring that you contribute the maximum amount allowed.

- Planning for short-term and long-term financial goals: Your TFSA is a flexible savings vehicle that can be used for short-term and long-term financial goals, such as saving for a down payment on a home or for retirement. Knowing your contribution limit can help you plan and save for these goals more effectively.

- Avoiding penalties: If you exceed your TFSA contribution limit, you may be subject to penalties and taxes. Knowing your contribution limit can help you avoid these penalties and stay within the legal limits.

- Managing cash flow: Knowing your contribution limit can help you manage your cash flow by allowing you to plan your contributions over the course of the year, rather than making a large lump sum contribution at the last minute.

- Making informed financial decisions: Knowing your TFSA contribution limit is a key piece of information that can help you make informed financial decisions about your savings and overall financial planning.

Once you are signed in to your CRA My Account, you can check your current TFSA Contribution Limit.

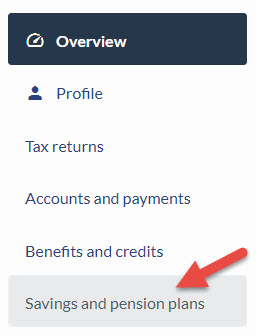

Step 1 - Overview Screen

- From the CRA My Account Overview screen, click on the Savings link on the right Navigation

- This will take you to the Savings and pension plans screen

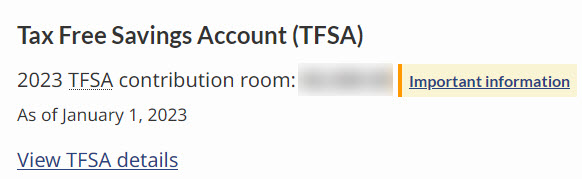

Step 2 - Tax Free Savings Account (TFSA)

- Your most recent TFSA Deduction Limit is listed on the RRSP and TFSA Screen

- You can also click on View TFSA details to see more information

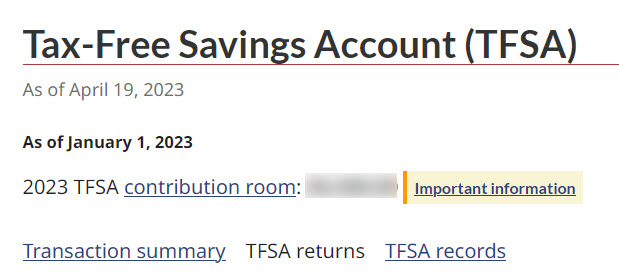

Step 3 - TFSA Details

You can see the details of your TFSA History including:

- Contribution room

- Transaction summary

- View TFSA returns

- View TFSA records

Do you have any questions about your contribution limits?

If you have questions about either your RRSP or TFSA contribution limits, please fill out the form below to contact our office and we would be happy to help.

Thank you for getting in touch!

One of our colleagues will get back to you shortly.

Have a great day!